The Lok Sabha approved a proposal by the government as part of amendments to the Finance Bill, 2017 that relaxes conditions for corporate funding to political parties. One of the major points of controversy surrounding the move is the confidentiality provided to corporate and removal of limit on funding as regards to proportion of profit previously limited at 7.5 per cent. On the face of it, the move seems to make the political funding system more opaque. However, diving deep, it actually makes sense to remove these restrictions as it allows accounted money from corporate to flow into the political system rather than unaccounted money that finds its way into the system dubiously filtered through multiple channels.

The move may fare better on merit in comparison to the previous system in place where large amount of unaccounted cash found its way into the political parties’ funding through anonymous donations. Political parties have to file income tax returns, and the funding will be on record. Increase in corporate funding can also not be classified as a conflict of interest unless proven otherwise.

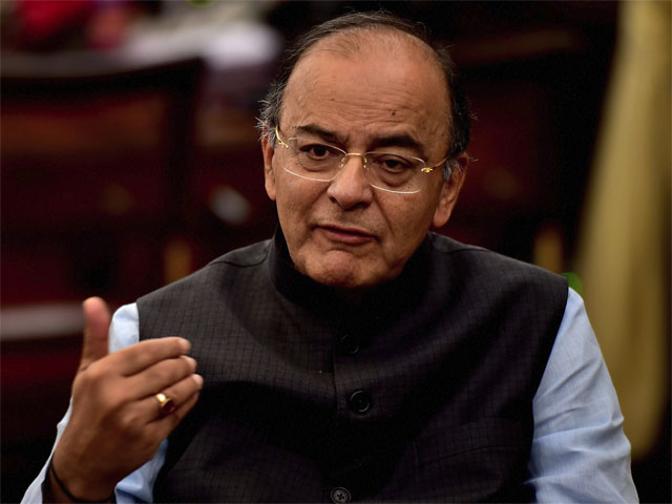

Finance Minister Arun Jaitley had announced in his budget speech that the government would restrict political party funding to ₹2,000 from ₹20,000 in cash. That cut was implemented after Election Commission of India asked the government to reduce the limit of anonymous funding.

The move was aimed to transition away from cash. There is the odd chance that this loophole may get exploited but donations to organisations can be anonymous in India and it is not exclusive to political parties. The fair thing to do was to drastically reduce the anonymous donation amount.

The current move can be dissected on two major aspects. Firstly, limitless donations are only allowed through digital and cheque route which means accounted money is transferred to the party’s accounts. The facility would seem to allow larger donations from single channel corporate donations as against multiple channel individual donations which are difficult to track as corporate donors are answerable to more bodies than individuals.

The companies are now allowed to keep the name of the party they contribute funding to as confidential in their profit and loss account. Earlier, they had to disclose the amount contributed and the name of the party.

As part of the Finance Bill, amendments will be done to the Companies Act to remove the cap on corporate funding to political parties and also to allow companies to keep the name of the beneficiary political party confidential. The amount of donation will, however, have to be mentioned in the company’s accounts. According to the Companies Act, the donations will also be allowed only after a resolution is passed by the board of directors of a company. Till now, companies could only contribute 7.5% of the average net profit of last three fiscals. In developed countries, anonymous corporate donations are common practice.

Expenditure incurred by a company on behalf of a political party in any manner, even going as publishing campaign material for the party, would be taken as a monetary contribution to the party.

The finance bill also announced electoral bearer bonds. The government has issued bearer bonds in the past as well but the program was discontinued. In 1987, the government of India issued Indira Vikas Patra bearer bonds issued at post offices which gave anonymity to the holders of the bonds.

Electoral bonds are only allowed to be bought via cheque or digital payments at authorized banks and these can only be redeemed at a designated bank account of a registered political party for which the bond is purchased. Bearer bonds assume the characteristic of currency, hence redeemability is a major factor to ensure bearer bonds are not used as a conduit to launder dirty money.