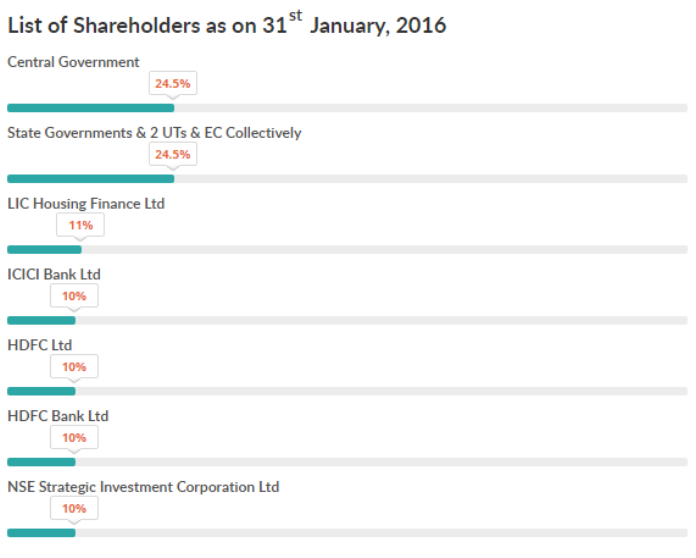

Was it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)? For a government that tended to be slow, it was a swift move to float this company with 51 percent private shares (see the graphic below). Centre and State Governments have only 49 percent in GSTN. Being a Section 25 company, GSTN is a not-for-profit organization. Then why do private entities have a majority stake in it? What is in it for them? As of Jan 31st, 2016 the list of shareholders in GSTN is-

Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?

On first looks, the most significant player in this tax collection effort should be the one who has the Data. In this case, that would be the Central and State Governments. Everything else such as adjusting the percentage of GST for various states is just a matter of programming, which could have been done by the Government itself. After all, it has codified Income Tax! This cannot be more complicated than that!

A closer look at the private partners reveals that entities such as the HDFC Bank, ICICI Bank and LIC Housing Finance Limited have shareholding of several foreign investments companies. In LIC Housing Finance Limited, among the 59 percent private shares, Abu Dhabi Investment Authority, Bank of Muscat, Mawer International Equity Fund, ICICI Prudential are the major private players.

In our opinion, tax administration is a sensitive matter dealing with sensitive information. Being a shareholder, would this automatically mean that HDFC and ICICI will be the bankers of public money collected through taxes? If yes, that would be a large amount of money passing through these banks! Also has the Home Ministry approved GSTN operators to allow them access to tax data?

The GST Bill has a long way to go. Only the constitutional amendments have been passed in the Parliament. States have to come on board and the final bill needs to be drafted and agreed to be made into law. Adequate security has to be established to ensure that this data does not fall in the wrong hands. There is still time to put the right structure in place. Will the Narendra Modi government do it?

Source-PGGurus, Google and other CAGIndia